Here’s an interesting nugget of info: 70% of Americans say their financial planning needs improvement.1 Yet, 60% of Americans don’t budget.2

That means people see they have a problem—but aren’t working the solution. Why? Often, they’re busy, afraid to look into their money situation, or at a loss for where to begin.

Budget methods abound, and it’s intimidating to pick one. But instead of playing “Pin the Tail on the Budget” after an online search (which would damage your screen anyway), let us help.

The 50/20/30 Rule is one popular method out there. But before you pin all your financial hopes and dreams on it, let’s look into what it means and how it works—and see if it’s the best way to budget.

What Is the 50/20/30 Rule?

First appearing in the 2005 publication All Your Worth, the 50/20/30 Rule is a budgeting plan that divides your spending and saving into three categories: needs (50%), savings (20%) and wants (30%).

Following this plan, the first step is to figure out your post-tax income (aka net income or take-home pay). Then you divide it in half. That’s for needs. The other half you split into 30% and 20%. But let’s go deeper still, because we aren’t surface people. We’re knowledge seekers.

Spend 50% on Needs

We all have needs. Some of us are needier than others. But by “needs” we don’t mean “high maintenance,” like your significant other or puppy.

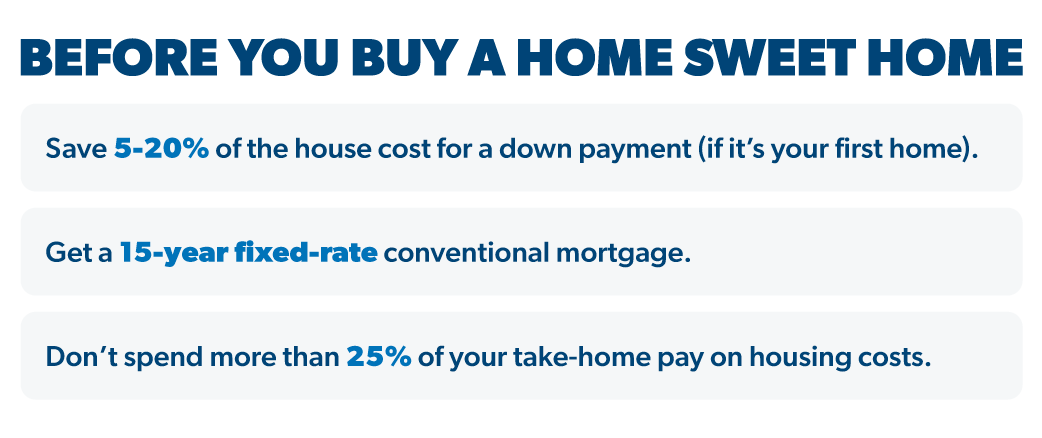

The needs you’re supposed to spend 50% of your income on are all the things that would majorly affect your life if you dropped them: food, shelter, home utilities, health insurance, transportation, and the minimum payments on all your debts.

You need to pay for those things, so they fall into this section.

Spend 20% on Savings

The Savings category covers a lot: retirement investments, emergency fund savings, and any extra debt repayments above and beyond the minimum payments.

That’s just 20% to set you up in safety and security with money now, in the immediate future, and in the farther off future of your golden years. Just 20%. To do all that. And you’re working on all three at once.

Okay, you can probably tell this is our biggest problem with the 50/20/30 Rule. But we have a couple other issues too.

Spend 30% on Wants

Read this carefully: Wants aren’t needs.

And we all know this—in theory. But when we start dividing things into budget categories based on wants versus needs, the lines can get fuzzier than your vision after you rub your eyes too hard.

Wants still impact our lives, but not like a need. We can do without wants.

The 50/20/30 Rule does a good job of bringing clarity to this truth. It says to spend 30% of your take-home pay on the stuff that ups your standard of living. This includes unlimited data plans, eating out, and new clothes—beyond the minimum amount dictated by temperature and society’s view of modesty.

If you really want to hit your money goals in life, though, your mindset shouldn’t be, “Woo-hoo! I get to spend 30% of my income on whatever I want! The budget plan tells me so!”

Remember: Wants aren’t needs. You can do without them as you work to build a better financial future. In fact, downplaying your wants for a while is a great way to get where you truly need to be.

What’s Missing From the 50/20/30 Rule?

While this is better than starting with no perimeters at all, it leaves budgeters with too little information. How much of the 50% goes toward food, utilities, housing and transportation? How can we keep from overspending in the wants category? That’s the fun stuff, after all.

Plus, that 20% savings section is for savings, retirement and extra debt payoff—all at once? That kind of thinking makes for very slow progress toward all your money goals. It leaves a lot of the feeling of “eventually.”

Eventually, I’ll be debt-free.

Eventually, I’ll have enough of an emergency fund so that I don’t run back to debt.

Eventually, I’ll feel secure about how much I’m putting in retirement.

Yuck. No thanks. We want to see these goals broken down with measurable objectives and timelines. We want to know when, and we want to make visual and obvious progress. This is why we love the 7 Baby Steps plan for our money goals (which we’ll cover in a minute).

And whichever goal you’re on, we think you should give it all you’ve got and more. If you’re in debt, take on a side hustle for a period of time so you can break up with loans and credit cards for good.

Give them the “it’s not me, it’s you” and the “you’re bad for me—and I’m not going to take your crap anymore” speeches.

Why We Recommend Using Zero-Based Budgets and the Baby Steps

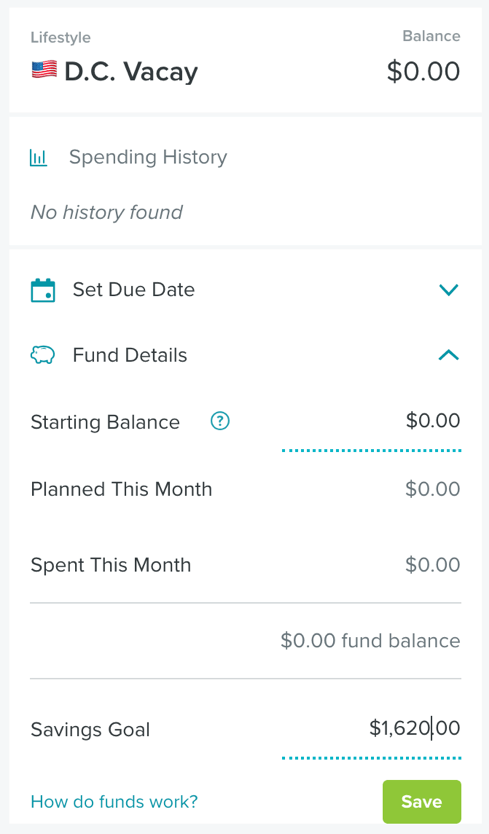

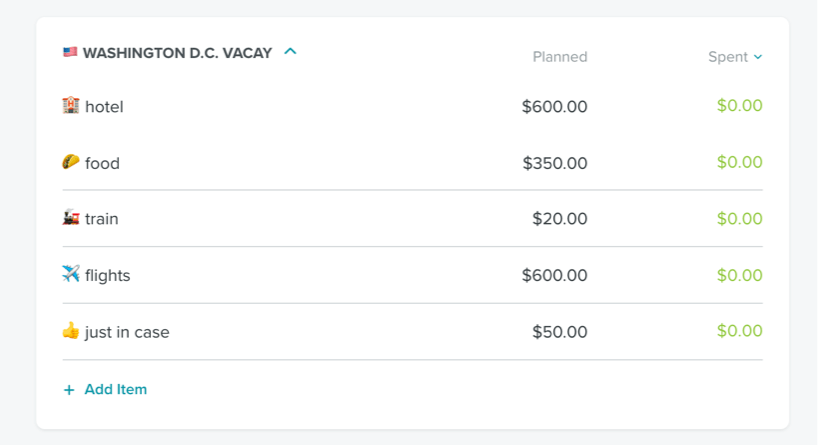

First of all, let’s define a “zero-based budget.” It means all your income minus all your expenses equals zero. And we love it.

Why? Zero-based budgeting gets every dollar every month working for you. It says that if there’s anything left after you cover necessities and other monthly spending, you give it a job—put it toward the money goal you’re working on at that time.

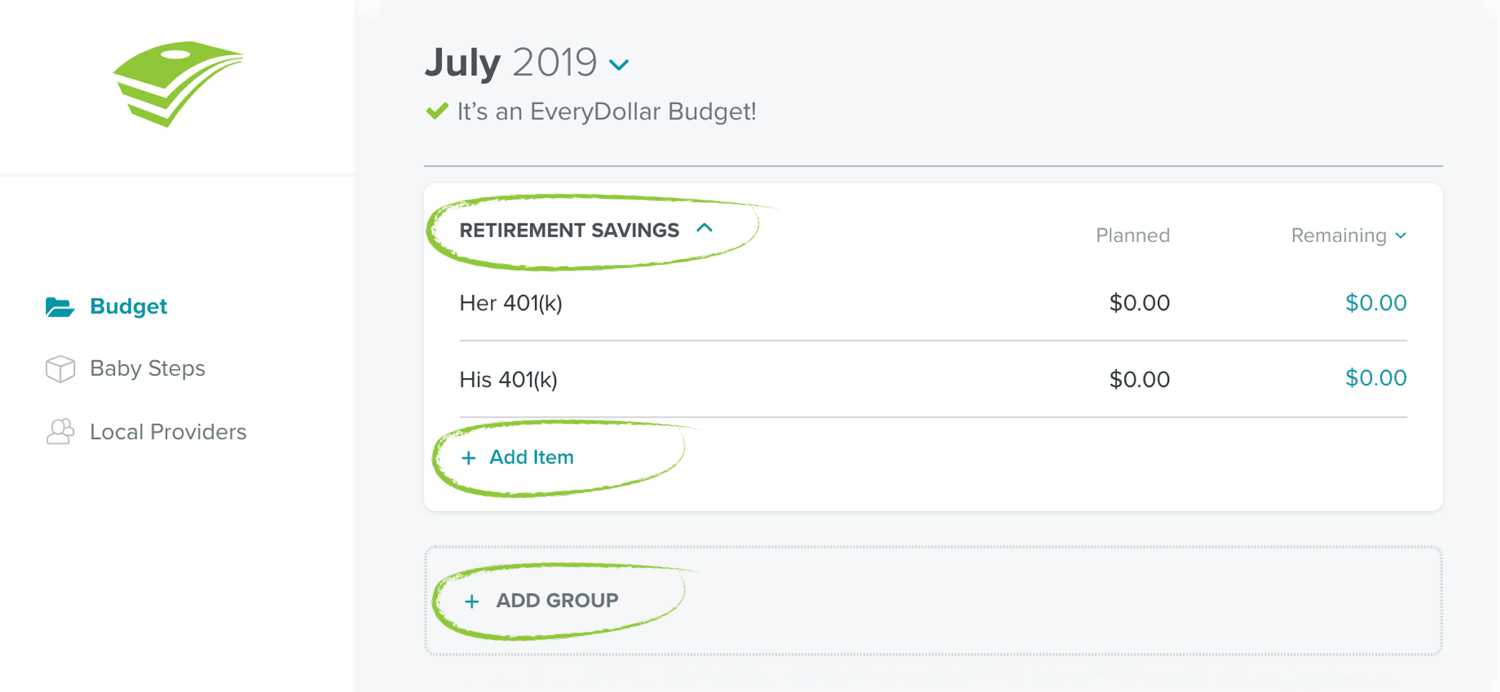

And zero-based budgeting works wonders with the 7 Baby Steps, which break down your financial goals into walkable, doable, progress-driven, and motivation-breeding steps.

With the Baby Steps, you take on one goal at a time with powerful intensity, instead of throwing money at multiple “eventuallys,” like that 20% savings category the 50/20/30 Rule lumps together.

We’re glad they’re encouraging people to save money, invest in retirement, and pay a little more on debt than the bare minimum.

But trying to do all that at once is too much. It’s overwhelming and lacks focus. With the Baby Steps, you do all those things, one step at a time:

Baby Step 1 is saving $1,000 as a starter emergency fund.

Baby Step 2 is paying off all non-mortgage debt with a passion and power unrivaled by any superhero who ever donned a mask and spandex.

Baby Step 3 is saving up 3–6 months of expenses in a fully funded emergency fund so you feel secure knowing you’ve got cash ready for whatever life brings.

Baby Step 4 is starting to invest 15% of your take-home pay into retirement—prepping for a future life most people think exists only on the covers of magazines.

Guess what happens when you take those steps one at a time instead of struggling to do it all at once? You move forward.

And that’s what we want for you—to move forward in your money goals.

But first, you need a zero-based budget. Build the best budget possible so you can build the best life possible. We can help.